Single Electricity Market Explained

By Howard Williams, Associate Editor

A single electricity market is not simply a trading framework. It is an operational system that determines how electric power is priced, dispatched, balanced, and financed across interconnected grids. When markets are unified, generation decisions, infrastructure investment, and reliability planning shift from national isolation to regional optimization. For system operators, regulators, and market participants, this structure directly shapes long-term cost, security of supply, and renewable integration outcomes.

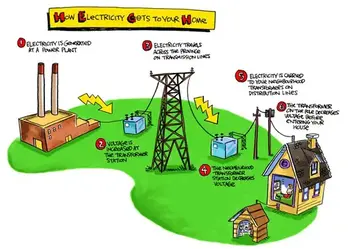

What a Single Electricity Market Actually Does

A single electricity market unifies previously separate wholesale markets into a common scheduling, pricing, and settlement environment. Generators submit offers, suppliers submit demand, and a central market process determines which resources operate and at what price for each trading interval.

This structure controls three system realities:

• Where electric energy is dispatched.

• How prices are formed.

• How system risk is shared across regions.

Instead of each grid carrying independent reserve margins, capacity and flexibility are pooled. This reduces duplication, improves resilience, and lowers system-wide operating costs.

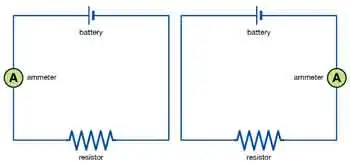

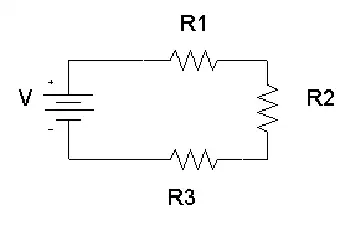

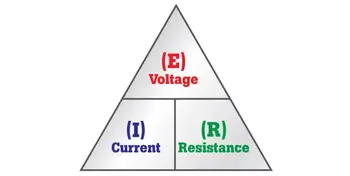

How Pricing and Dispatch Work

Prices in a single electricity market are determined through a market-clearing process that matches supply with demand while respecting network constraints. Generation is selected based on economic merit, and settlement systems distribute payments accordingly.

This pricing structure determines where infrastructure capital ultimately flows. When prices accurately reflect system conditions, they guide investment in generation, storage, and interconnection, which is why accurate forecasting remains central to Electricity Demand Canada.

Accurate forecasting, therefore, becomes a structural requirement rather than a planning preference.

How SEMO Works in the Integrated Single Electricity Market

| Function | Description | Impact on Market |

|---|---|---|

| Market Operation | SEMO administers the wholesale electric ernergy market, scheduling and dispatching generation based on bids and demand forecasts. | Ensures power is produced and delivered at least cost while maintaining system balance. |

| Settlement & Pricing | Calculates market-clearing prices, settles payments between generators, suppliers, and traders, and publishes transparent pricing data. | Provides fair competition and reliable price signals for investment and trading. |

| Integration of Renewables | Incorporates renewable sources of electric energy (e.g., wind, solar) into dispatch schedules, balancing variability with conventional generation and reserves. | Promotes sustainability and supports EU decarbonization targets. |

| Regulatory Compliance | Operates under the oversight of the SEM Committee and national utility regulators, ensuring compliance with aligned market rules and codes. | Builds trust in market integrity, fairness, and transparency. |

| Cross-Border Trading | Coordinates with transmission system operators (TSOs) to enable interconnection and market coupling with neighboring regions. | Enhances security of supply, increases efficiency, and lowers overall costs. |

| Dispute Resolution & Transparency | Publishes market reports, handles queries, and participates in regulatory processes with input from independent members (including the deputy independent member). | Strengthens accountability and confidence among stakeholders. |

Why Single Electricity Markets Are Strategically Important

Single electricity markets exist because isolated systems are structurally inefficient.

They deliver value through:

Cost Control

Competition across a larger market lowers long-term wholesale cost pressure.

Security of Supply

Shared reserves reduce outage and price-spike risk.

Renewable Integration

Geographic diversity stabilizes variable generation.

Investment Confidence

Transparent market rules and pricing encourage long-term infrastructure investment and define how modern Electricity Supply systems operate within competitive and regulated markets.

These effects directly influence how transmission is justified, how capacity is planned, and how energy transitions are funded.

The Irish Single Electricity Market as a Practical Model

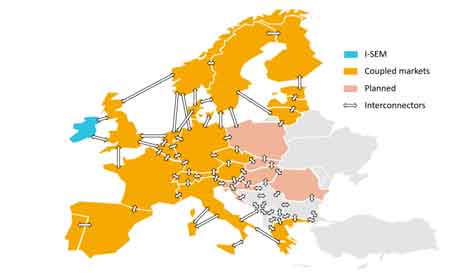

Ireland and Northern Ireland demonstrated that two jurisdictions can operate a unified wholesale power system while maintaining regulatory oversight and reliability. Subsequent reforms aligned the market with broader European structures, improving price transparency, market coupling, and the integration of renewables.

This system now serves as a reference model for regional integration worldwide.

Market transparency also determines how every Electricity Supplier manages tariffs, reliability obligations, and long-term system planning within a single market.

Operational Implications for Grid and Market Professionals

For planners, operators, and regulators, a single electricity market changes professional responsibility:

• Planning becomes regional.

• Reserves become shared assets.

• Congestion becomes an economic signal.

• Flexibility becomes a market product.

Market design, therefore, becomes as important as physical infrastructure.

Challenges That Must Be Managed

Single electricity markets are powerful, but they are not simple.

The main challenges include:

Regulatory Misalignment

Conflicting rules distort pricing, especially in regions shaped by Electricity Deregulation and evolving competitive frameworks.

Congestion Management

Interconnection capacity must be managed carefully to prevent price separation and inefficiency.

Political Risk

Changes in national policy can disrupt long-term market confidence.

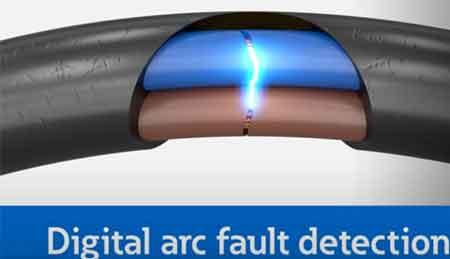

Renewable Variability

High renewable penetration increases the need for flexible resources, fast markets, and strong system coordination.

These challenges explain why successful SEMs require strong governance and continuous refinement.

Global Perspective

Different regions apply the single electricity market concept in different ways. Europe focuses on regulatory harmonization and market coupling. North American markets emphasize competitive pool structures. Nordic systems demonstrate how renewable-rich regions can trade efficiently across borders. Australia shows how distance and network constraints complicate market design.

These variations highlight an important point: a single market is not a template; it is a framework that must be adapted to local system realities.

Why the Single Electricity Market Matters for the Energy Transition

As power demand grows and renewable penetration increases, isolated markets become less viable. A single market allows systems to share flexibility, reduce curtailment, and maintain reliability while decarbonizing.

For professionals responsible for system performance, market design, and policy alignment, the single electricity market is no longer optional. It is becoming a structural requirement of modern power systems.