Alternative Energy Tax Credits - Green Energy Cost Savings

Alternative energy tax credits reduce CAPEX for solar PV, wind turbines, battery storage, EV charging, and high-efficiency HVAC, with IRS incentives, rebates, and depreciation accelerating power electronics upgrades and grid integration for clean energy projects.

A Practical Guide to Alternative Energy Tax Credits

How can I earn money using alternative energy? New financial incentives are available to homeowners and businesses for a number of alternative energy and energy efficiency measures. For a broader overview of current programs, see the resource at alternative energy incentives which summarizes eligibility and timelines.

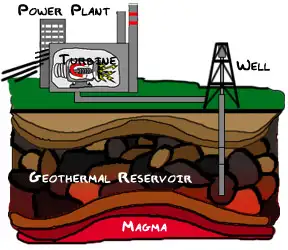

- Alternative energy tax credits for residential and commercial photovoltaics, solar water heating systems, geothermal heat pumps, and other renewable technologies.

- Alternative energy tax credits for homeowners for energy efficiency improvements to existing homes.

- Alternative energy tax credits for builders of highly efficient new homes.

- Alternative energy tax deductions for owners or designers of highly efficient commercial buildings.

- Alternative energy tax rebates for energy efficient appliances

Alternative Energy Tax Credits Using Solar and Renewables For Residential Homes

If you're new to the space, this concise primer on what is alternative energy helps frame the technologies covered in this section.

For new and existing homes, alternative energy tax credit limitations have been removed by some country's governments for many alternative energy systems including geothermal heat pumps, solar water heaters, solar photovoltaics, small wind energy, fuel cells and microturbine systems. Qualified products can receive an alternative energy tax credit equal to 30 per cent of their cost. Many homeowners start by reviewing the latest renewable energy tax credits before requesting contractor quotes.

Some examples of alternative energy tax credit qualified products are:

When weighing options like PV and solar thermal, this overview of alternative energy solar power clarifies system types, site suitability, and typical payback periods.

- Solar water heating systems property certified by the Solar Rating and Certification Corporation (SRCC) which provide at least 50 per cent of the system demand.

- Photovoltaic systems which provide electric power for the residence.

- Wind energy systems which provide 100 kW or less electric power to the residence.

- Geothermal heat pumps which satisfy the ENERGY STAR criteria.

- Fuel cells with a capacity = 0.5 kW and efficiency = 30 per cent.

- Microturbines with a maximum capacity of 2,000 kW and a minimum efficiency of 26%.

Alternative Energy Tax Credits For Existing Homes - Energy Efficiency

To align upgrades strategically, compare technologies using this guide to renewable alternative energy so your efficiency measures complement future renewable additions.

Qualified products receive an alternative energy tax credit of 30% of their cost, up to the $1,500 limit.

Some examples of alternative energy tax credit qualified products are:

- Insulation material which meets 2009 IEEC and amendments.

- Exterior windows with SHGC = 0.30 and U-factor = 0.30.

- Exterior doors with SHGC = 0.30 and U-factor = 0.30.

- Furnaces using natural gas or propane with an AFUE = 95.

- Geothermal heat pumps (Not subject to $1,500 cap):

- Hot water boiler with natural gas, propane, or oil furnace and AFUE = 90 per cent.

- Advanced main air circulating fan used in natural gas, propane, or oil furnace that uses no more than 2% of the total annual energy use of the furnace.

- Water heater using natural gas, propane, or oil with EF = 0.82 or a thermal efficiency = 90%.

- Water heater using an electric heat pump with EF of 2.0 or greater.

- Biomass stoves with efficiency rating of at least 75 per cent and used to heat a home or heat water.

Alternative Energy Tax Credits For Commercial Buildings

Owners or tenants (or designers, in the case of publicly-owned buildings) of new or existing commercial buildings may qualify for a tax deduction of up to $1.80 per square foot. The buildings must be constructed or reconstructed to save at least 50 per cent of the heating, cooling, water heating, and interior lighting energy cost of a building that meets ASHRAE Standard 90.1-2001.

Each of the three energy-using systems of the building — the envelope, interior lighting system, and heating and cooling system — is eligible for one third of the incentive ($0.60/ft) if it meets its share of the whole-building savings goal. Case studies of compliant facilities can be found among curated alternative energy projects that detail design choices and savings outcomes.

Software meeting federal tax laws for accuracy and consistency determines projected energy savings. Third party inspectors review the plans and verify building parameters to determine compliance.

Alternative Energy Tax Credits For Businesses

The business investment tax credit varies from 10% to 30% depending upon they type of system installed. This alternative energy tax credit is possibly available to businesses that purchase solar water heaters, solar photovoltaics, small wind energy, geothermal heat pumps, fuel cells and microturbine systems.

Combined Incentives For Alternative Energy Tax Credits

In many cases, multiple tax incentives may be claimed. In the case of a new home for example, the builder may claim credit for the high efficiency home and the homeowner may claim tax credits for solar hot water, photovoltaic, and fuel cell systems. Other financial incentives, such as local utility rebates, further reduce the cost of building or owning a solar and energy efficient home. To supplement credits and rebates, many jurisdictions also offer targeted alternative energy grants that can further reduce upfront costs.