US Data Centers Forecasted To Strain Grid

Electrical Testing & Commissioning of Power Systems

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 12 hours Instructor-led

- Group Training Available

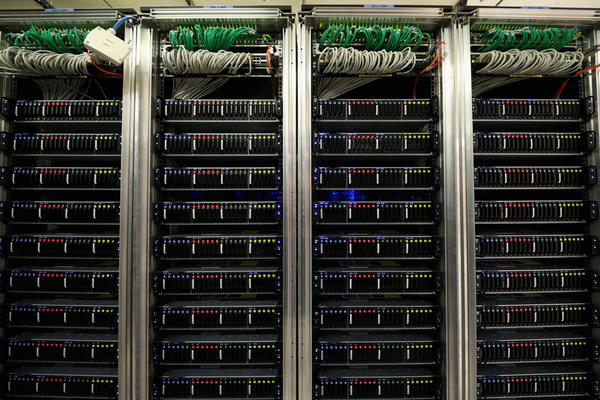

U.S. data-center electricity demand is projected to reach 106 gigawatts by 2035, far higher than earlier expectations. The rapid expansion of AI-driven data facilities is raising serious concerns about grid reliability, reserve margins and regional infrastructure limits.

At A Glance

• Data-center power demand in the U.S. could reach 106 GW by 2035, sharply higher than earlier estimates

• Nearly one quarter of new data-center projects exceed 500 MW

• PJM and Texas forecast tightening reserve margins and grid-stress risks

• AI-driven load growth reshapes where future U.S. data centers are being built

U.S. Grids Brace as Data-Center Power Demand Surges

U.S. data-center electricity demand is now projected to climb to 106 gigawatts by 2035, a dramatic jump from prior expectations and a sign of how quickly AI-driven computing is transforming national power needs. The surge reflects both the sheer number of new data-center projects and their increasing size, with nearly a quarter of new facilities rated at 500 megawatts or more. Analysts note that the projected surge closely mirrors trends outlined in Data Center Demand Booms, which tracked how hyperscale facilities have begun outpacing traditional grid expansion timelines.

This rapid buildout is colliding with tight regional grid conditions. In the PJM Interconnection region, data-center load could rise to 31 GW by 2030, approaching the amount of new generation expected over the same period. In Texas, reserve margins could fall into risky territory after 2028, signaling that short-term growth can be absorbed but long-term supply may lag behind rising demand. Some experts compare the situation to the rapid construction wave seen in Rise of Data Centers in Alberta, where provincial planners struggled to keep infrastructure aligned with commercial demand.

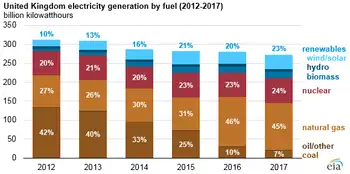

The expanding use of AI, cloud services, and high-density computing is pushing operators to rethink how the grid can accommodate massive and unpredictable loads without jeopardizing reliability or driving up energy costs. Many analysts describe this moment as a critical pivot point for U.S. power planning, where grid operators must balance accelerating load growth with long-term generation and transmission investment. Observers say the U.S. market is now echoing the massive build-outs seen in China Data Center, where soaring computing requirements reshaped national electricity strategies.

Geography is shifting as well. Northern Virginia, historically the nation’s center of data-center development, is nearing saturation. New projects are moving into southern and central Virginia, while Georgia is seeing expansion outside metro Atlanta as land and power availability tighten. Texas remains a standout market, where former crypto-mining sites are being converted into AI data centers near population hubs and fibre routes, allowing developers to scale quickly.

Grid operators warn that integrating these huge facilities will require new planning tools similar to those explored in Integrating AI Data Centers into Canada's Electricity Grids, which highlighted the challenges of balancing reliability with explosive load growth.

As demand accelerates, U.S. grids face a foundational challenge: how to support the next decade of digital growth while maintaining reliability, affordability and the pace of clean-energy development.