Next Offshore Wind in U.S. Can Compete With Gas, Developer Says

CSA Z462 Arc Flash Training – Electrical Safety Compliance Course

Our customized live online or in‑person group training can be delivered to your staff at your location.

- Live Online

- 6 hours Instructor-led

- Group Training Available

Offshore Wind Cost Competitiveness is rising as larger turbines boost megawatt output, cut LCOE, and trim maintenance and installation time, enabling projects in New England to rival natural gas pricing while scaling reliably.

At a Glance

It describes how larger offshore turbines lower LCOE and O&M, making U.S. projects price competitive with natural gas.

Larger rotors and ratings lift yield and cut LCOE about 50 percent.

Bids indicate cost parity with gas in constrained New England markets.

800 MW Vineyard Wind and 400 MW Deepwater projects advance scale.

Intermittency limits firm capacity; needs storage or capacity market support.

Massive offshore wind turbines keep getting bigger, as projects like the biggest UK offshore wind farm come online, and that’s helping make the power cheaper — to the point where developers say new projects in U.S. waters can compete with natural gas.

The price “is going to be a real eye-opener,” said Bryan Martin, chairman of Deepwater Wind LLC, which won an auction in May to build a 400-megawatt wind farm southeast of Rhode Island.

Deepwater built the only U.S. offshore wind farm, a 30-megawatt project that was completed south of Block Island in 2016. The company’s bid was selected by Rhode Island the same day that Massachusetts picked Vineyard Wind to build an 800-megawatt wind farm in the same area, while international investors such as Japanese utilities in UK projects signal growing confidence.

#google#

Bigger turbines that make more electricity have cut the cost per megawatt by about half, a trend aided by higher-than-expected wind potential in many markets, said Tom Harries, a wind analyst at Bloomberg New Energy Finance. That also reduces maintenance expenses and installation time. All of this is helping offshore wind vie with conventional power plants.

“You could not build a thermal gas plant in New England for the price of the wind bids in Massachusetts and Rhode Island,” Martin said Friday at the U.S. Offshore Wind Conference in Boston. “It’s very cost-effective for consumers.”

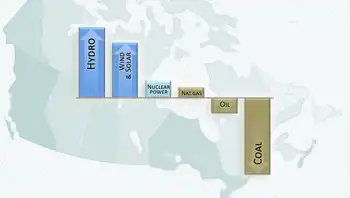

The Massachusetts project could be about $100 to $120 a megawatt hour, according to a February estimate from Harries, though recent UK price spikes during low wind highlight volatility. The actual prices there and in Rhode Island weren’t disclosed.

For comparison, a new U.S. combine-cycle gas turbine ranges from $40 to $60 a megawatt-hour, and a new coal plant is $67 to $113, according to BNEF data.

A new power plant in land-constrained New England would probably be higher than that, and during winter peaks the region has seen record oil-fired generation in New England that underscores reliability concerns. More importantly, gas plants get a significant portion of their revenue from being able to guarantee that power is always available, something wind farms can’t do, said William Nelson, a New York-based analyst with BNEF. Looking only at the price at which offshore turbines can deliver electricity is a “narrow mindset,” he said.